Happy New Year!

Phew!! The last 12 months have been somewhat eventful – a new president, banks going out of business, the Stock Exchange at an all time low, and the housing market crashing………

Many of us have been affected by one or more of the above. And like the government and banks, we have been unsure which way to turn. With the New Year starting, we are all a little wiser and reassured that things can only get better.

Today’s Market

The real estate market has been very prominent in the media over the last two years, with prices plummeting and record number of foreclosures. The banks have never before had to deal with such volume of real estate on their books and this has in some cases been their downfall.

We are continuing to see a high volume of Short Sale properties entering the market and there are still a number of realtors and banks out there still educating themselves to deal with the volume. Wells Fargo, Bank of America and JPMorgan Chase are hiring and training more staff, developing software systems for expediting short sales and increasing their marketing of short sale options to delinquent borrowers.

Experts predict that this first quarter will see an increase in activity due to historically low interest rates and everyone trying to beat the $8,000 Tax Credit deadline of June 30, 2010. Sellers will face a busier market as early as February. So now is the best time to sell your home.

Proposed Treasury’s Plan

The Treasury and the Government are now insisting that the banks need to get organized and do whatever is necessary to keep homeowners in their homes. They are proposing that the Treasury would pay up to $1,500 for a homeowner to relocate, $1,000 to loan servicing companies that accept a sale and a maximum of $1,000 to help settle a second mortgage or subordinate lien. The lender must agree to release the borrower from all liability of repayment of the balance for the mortgage, under the proposed Treasury plan.

Tax Credit

The $8,000 tax credit certainly helped young and first time buyers get into the housing market. The extension issued in November will help the market continue to move during the first quarter of this year. Buyers are taking advantage of the Tax Credit and historically low interest rates. This will help reduce the inventory and stabilize the house prices.

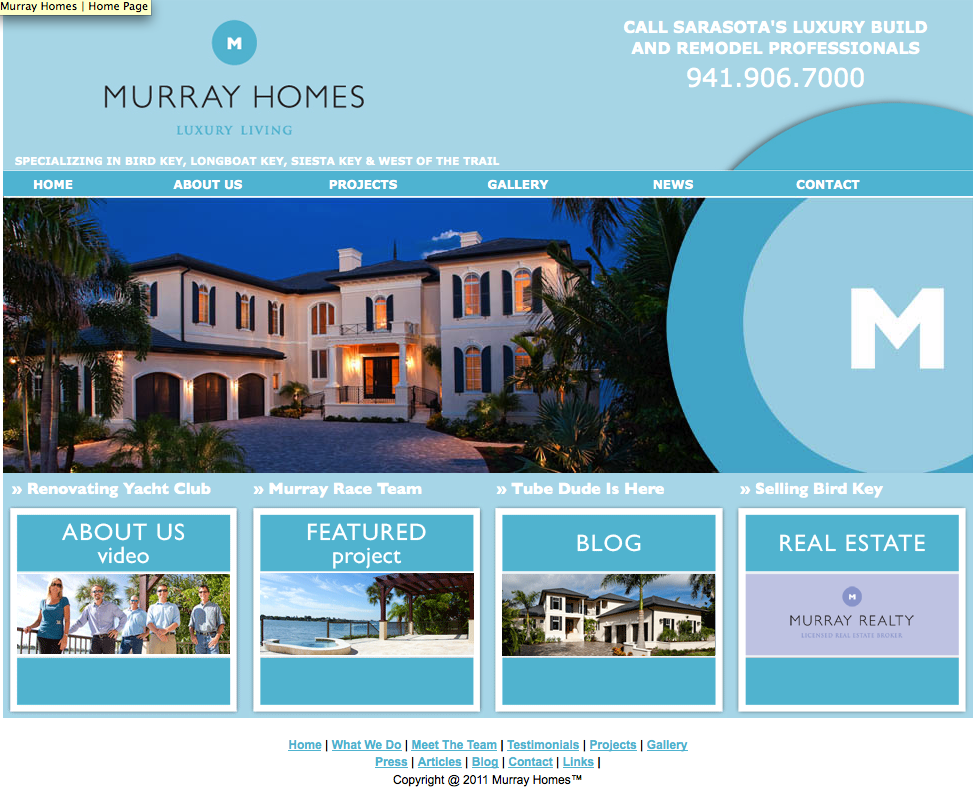

Sarasota Market

In December 2009, Sarasota recorded the highest number of sold transactions since March 2007. Short Sales and REO/bank owned properties impacted the Sarasota market in 2009. Distressed property sales accounted for 40% of all sales compared to 21% in 2008.

Foreclosure and Short Sales

An estimated 7 million foreclosures loom in the next two to three years, according to RealtyTrac. Foreclosure filings are still up 18% from a year ago and a new wave is expected this year as unemployment remains high and borrowers fall out of loan modification programs. More than half of the loan modifications of delinquent mortgages re-default within a year, according to a report by the Office of the Comptroller of the Currency. The underlying problems are still there so the foreclosure crisis is likely to get worse before it gets better. More than 14% of homeowners with a mortgage are either late on their payments or in foreclosure and that number is expected to keep rising as unemployment remains stubbornly high.

Short Sale properties can benefit a neighborhood because they clear out stagnant homes and bring in fresh owners with intentions of improving. It also releases the homeowner from a lien(s) that they are unable to pay due to a hardship, without hurting their credit score too much.

Credit Score

A borrower’s credit history after a short sale is typically reported as “settled” and considered as severe as a foreclosure. According to Minneapolis-based FICO Corp, it may drop a credit score of 780 to 620.

I hope this information has been useful to you. If you know someone that is struggling with their mortgage and a short sale may be the way forward. Please do not hesitate to give them our contact details. We are happy to help!